Table of Contents

ToggleOverview

Tykr is an innovative investment platform designed to simplify the stock market for both novice and experienced investors. It offers a unique algorithm that assesses stocks for risk and potential returns, categorizing them as “On Sale” (undervalued), “Watch”, or “Overpriced”.

This clear, easy-to-understand system helps users make informed decisions quickly. Tykr supports its users with educational resources that enhance their understanding of investment strategies and market dynamics. The platform also provides real-time financial data and analysis tools, enabling users to track their investments effectively.

Tykr’s community feature allows investors to exchange ideas and strategies, fostering a collaborative environment. With a focus on transparency, Tykr ensures that all users have access to the same quality information.

The platform is accessible from various devices, ensuring users can manage their portfolios anytime, anywhere. Tykr aims to democratize investing, making it accessible and understandable for everyone. Its commitment to user empowerment and education sets it apart in the fintech space.

Key Features of Tykr

Stock Screener:

Tykr provides a powerful stock screener that evaluates stocks using a proprietary algorithm, helping users identify which stocks are undervalued (“On Sale”), fairly priced (“Watch”), or overpriced (“Overpriced”).

Risk Assessment:

The platform offers a straightforward risk assessment for each stock, making it easier for investors to understand potential risks and rewards.

Educational Resources:

Tykr includes a variety of educational materials aimed at improving users’ understanding of investing principles and stock market basics.

Real-Time Data:

Users have access to real-time financial data, which is crucial for making informed investment decisions.

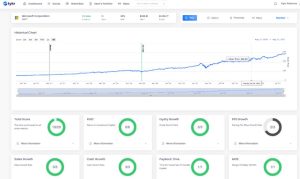

Analysis Tools:

The platform provides advanced analysis tools that allow users to perform deep dives into stock performance, financial health, and market trends.

Community Interaction:

Tykr fosters a community environment where users can share insights, discuss strategies, and learn from each other.

Portfolio Management:

It offers tools for tracking and managing personal investment portfolios, helping users oversee their investments efficiently.

Multi-Device Accessibility:

The platform is designed to be accessible on various devices, ensuring users can manage their investments on-the-go.

Transparency:

Tykr emphasizes transparency in its operations, providing users with clear and understandable information about its methods and the stocks it analyzes.

User-Friendly Interface:

The interface is designed to be intuitive, making it easy for both beginners and experienced investors to navigate and use the platform effectively.

Pros of Tykr

Simplified Decision-Making:

Tykr’s algorithm simplifies the process of evaluating stocks by categorizing them into clear, actionable categories: On Sale, Watch, and Overpriced. This helps users make quick and informed investment decisions.

Educational Support:

The platform provides extensive educational resources that help users understand the fundamentals of investing and the stock market, which is particularly beneficial for beginners.

Risk Management:

By assessing the risk and potential return of each stock, Tykr helps investors manage their risk exposure more effectively.

Real-Time Updates:

Access to real-time financial data ensures that users can react promptly to market changes, which is crucial for maintaining a competitive edge.

Community Engagement:

The community aspect of Tykr allows users to learn from each other, share strategies, and gain insights, which can enhance their investing experience.

Comprehensive Analysis Tools:

Tykr offers robust analysis tools that enable users to delve deep into stock performance and market trends, aiding in more nuanced investment strategies.

Accessibility:

The platform’s compatibility with multiple devices means users can manage their investments from anywhere, at any time, which adds a layer of convenience.

Transparency:

Tykr’s commitment to transparency ensures that all users have access to the same high-quality information and understand how stocks are evaluated.

User-Friendly Interface:

The intuitive design of the platform makes it easy to navigate, reducing the learning curve for new users and enhancing the overall user experience.

Portfolio Tracking:

Users can easily track and manage their investment portfolios directly through the platform, helping them keep a close eye on their financial goals and adjust strategies as needed.

Cons of Tykr

Algorithm Dependence:

Users heavily rely on Tykr’s proprietary algorithm for stock evaluations, which might not always align with individual investment strategies or market nuances.

Limited Personalization:

The platform may not offer enough customization options for more advanced investors who prefer to tailor their analysis and screening criteria.

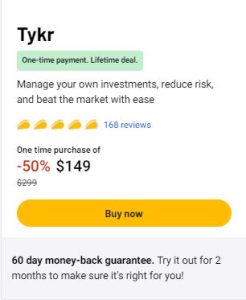

Subscription Cost:

Tykr operates on a subscription model, which might be a barrier for users looking for free investment tools.

Market Coverage:

Depending on the markets Tykr covers, some investors might find it lacking if they are interested in less mainstream stocks or international markets not supported by the platform.

Oversimplification:

While the categorization of stocks into On Sale, Watch, and Overpriced simplifies decision-making, it might oversimplify complex market dynamics, potentially leading to missed opportunities or misjudgments.

Data Overload:

For beginners, the wealth of data and analysis tools, while helpful, can also be overwhelming and difficult to interpret without sufficient investment knowledge.

Community Bias:

The community-driven advice and discussions can be beneficial, but they also risk introducing bias or groupthink into investment decisions.

Technical Issues:

As with any digital platform, users may occasionally face technical issues such as downtime or bugs that can hinder their ability to trade effectively.

Learning Curve:

Despite its user-friendly interface, there is still a learning curve associated with understanding how to best utilize all the features Tykr offers.

Dependence on Internet Connectivity:

Since Tykr is an online platform, users need a reliable internet connection to access their portfolios and make timely decisions, which could be a limitation in areas with poor connectivity.

Alternatives of Tykr

Yahoo! Finance:

A comprehensive platform offering real-time data, news updates, financial tools, and a stock screener. It’s suitable for both beginners and experienced investors.

Simply Wall St:

This platform provides visual analytics and easy-to-understand infographics that help investors make informed decisions. It’s a good option for those who prefer a more visual approach to stock analysis.

Finbox:

Finbox offers detailed financial data and custom valuation models, making it ideal for more advanced users who need in-depth financial analysis.

Wallmine:

This is a financial data aggregator that provides real-time stock quotes, financial news, and market information. It also features a powerful stock screener.

Google Finance:

Known for its clean interface and integration with Google’s ecosystem, Google Finance provides basic stock tracking and financial news.

Seeking Alpha:

Best for those who value research-driven insights, Seeking Alpha offers comprehensive investment research, including crowd-sourced content from a large community of investors.

Investing.com:

This platform offers extensive tools for financial analysis across global markets, including real-time data, charts, and economic calendars.

CityFALCON:

CityFALCON provides personalized financial news and content based on your portfolio or interests, making it easier to stay informed about relevant market developments.

Empower (formerly Personal Capital):

Best for comprehensive financial tracking, Empower offers tools for budgeting, investment tracking, and retirement planning.

Sharesight:

This tool is particularly useful for tracking international investments and tax implications, offering automated performance reports and dividend tracking.

Appsumo Tykr

FAQ

Q: Is Tykr suitable for new investors?

A: Yes, Tykr is designed to be user-friendly for both beginners and advanced investors. It provides tools and educational resources that help new investors understand the stock market and make informed investment decisions.

Q: What is the difference between investing and trading on Tykr?

A: Tykr is primarily used for investing, which involves buying stocks that are undervalued and holding them to leverage the power of compound interest. This is considered a safer, more conservative approach compared to trading, which involves frequent buying and selling of stocks for short-term profits.

Q: Is Tykr a guaranteed way to make money?

A: No, Tykr is not a silver bullet for financial success. It provides tools and information to help users make better investment decisions, but like all investments, there are risks involved.

Q: Can I use Tykr for day trading?

A: Tykr is not designed for day trading. It is focused on long-term investing by identifying stocks that are “On Sale” and likely to provide good returns over time.

Q: Does Tykr act as a broker?

A: No, Tykr is a stock screener and educational platform, not a brokerage. Users need to use a separate brokerage account to buy and sell stocks.

Q: Can I find international stocks on Tykr?

A: Yes, Tykr includes both US and non-US stocks, offering a broad range of investment options globally.

Q: How do I pronounce ‘Tykr’?

A: Tykr is pronounced “Ticker,” similar to stock ticker symbols.

Q: What should I do if my stocks purchased through Tykr recommendations decrease in value?

A: Tykr advises holding onto stocks that are purchased when they are “On Sale,” as these are generally strong companies whose stock prices are likely to recover and grow over time. Selling during a downturn can lead to losses, which contradicts the investment strategy recommended by Tykr.

Q: How much time should I spend on Tykr each week?

A: Users can spend as little as 15 minutes per week on Tykr to successfully manage their investments, although more dedicated users may choose to spend more time exploring potential investments.

Q: How many stocks should I own in my portfolio?

A: Tykr recommends owning between 10 and 15 stocks to avoid over-diversification and to maximize potential returns from a focused portfolio.

Visit WP Plugin